Overachievement

Just about every path we take is paved with uncertainty. You can never be sure when your health might fail, your house might burn down, or your profession might suddenly be shuttered into irrelevance.

Of course, those are worst-case scenarios. More likely is injury by a thousand cuts; a steady process of small setbacks that stymie progress over time.

It is our mission to build a bulwark against the unknown, and history shows that it is only when some success is had that we reach beyond expected outcomes. In other words, that security preempts prosperity is one of the more readily available truths about human activity.

It is curious then that instead of being seen as a means of securing the future, the pursuit of wealth is often characterized as a selfish grasping towards zero-sum material gain. Factor in that the principals at hand are also counterintuitive, and you have a situation where many are convinced wealth is both hard to get and morally wrong to have.

This post will not have the scope to really dive into that claim. However, if you just replace the word “wealth” in that sentence with “security,” it becomes perhaps self-evidently problematic.

Security and wealth are not perfect synonyms. But they are close. We all recognize that some level of wealth is needed to get anywhere in life. What’s less clear is that security scales with wealth much better than most realize.

While a wealthy person has long won the security of food, shelter, and comfortable retirement, she might yet feel insecure in pursuing more abstract targets like staring a nonprofit, making a risky angel investment, or diverting attention away from the machinery of her wealth towards something else she wants to achieve.

This is to say that wealth equals greater opportunity even for those that already have a lot of it. Take it all away we are reduced to a neurotic hedging against the uncertainty of the future. Grant us a little and we can secure positive outcomes for ourselves but are limited in how we can grow and help others. Give us a lot and we can change the world.

In this context, wealth is the medium over which we can scale good intentions.

Measuring Up

If you can be convinced of all that, your next question might have to do with the other major psychological roadblock: that accumulating wealth is hard to do.

It’s true that most people don’t do a very good job of becoming wealthy. The Millionaire Next Door is a classic that uncovers the surprising reality about household wealth and how it is gained.

To this end, they used a simple formula to measure how good any individual is at accumulating wealth relative to their peers. To calculate what level of wealth you should have acquired by now, you just take your age times your income and multiply the product by 10%. If you are 30 years old and earning $100k a year, for example, you get an “expected” net worth of $300k.

People as wealth accumulators can then be broken into three categories:

Under accumulators of wealth (UAWs) are those whose real net worth is less than one-half of their expected net worth.

Average accumulators of wealth (AAW) are on par with their expected net worth.

Prodigious accumulators of wealth (PAWs) have a net worth twice their expected level.

If you buy that wealth begets security and security begets flourishing, how you score on this scale should seem important. It’s understandable then if a low score causes anxiety. Nonetheless, clarifying your reality is worth the stress as it is a necessary first step towards change.

There’s also some good news. The book centers around the finding that wealth does not accumulate in ways that we might expect. High levels of wealth are typically associated with fancy degrees or extreme levels of skill; the people that have the best education and highest paying jobs are the wealthiest, and the rest must make do with leftovers.

It turns out that’s not exactly how it works. In fact, a wealthy upbringing and high income can even be counterproductive. The research found that the more one earns and the more privileged their background, the more they consume and the less they accumulate. More often, it was the blue-collar workers with lower incomes but better financial habits that were the prodigious accumulators of wealth over time.

The books surprising findings should lend insight into how to move forward from your current position. If you find yourself in command of high income but low wealth, you might want to take a closer look at what makes for a productive lifestyle. If you find yourself in command of low income and low wealth, the path forward isn’t as treacherous as it seems since you don’t have to find a way to command a high income overnight. Instead, you must simply learn the principals of wealth accumulation and apply them with consistency. If you can do that, you might even have an advantage over the silver spooned of the world as your spending habits probably don’t need reining in like those of someone who is used to high consumption.

For getting familiar with the principals of accumulating wealth, you can’t go wrong with The Richest Man in Babylon, Rich Dad Poor Dad or The Simple Path to Wealth.

The March of Real Estate

Those looking to build wealth might also consider investing in real estate. This is a poorly kept secret in general, but the key word here is “invest.” People buy real estate all the time and for many reasons, but investment return is not normally prioritized. If you are interested accumulating security, that should change.

An example should help illustrate the power of real estate as an investment.

Let’s stay you’re starting with $35k. A strategy called “House Hacking” would allow you to put three to five percent down on a property that you can then rent out rooms in to cover the mortgage, which for a $500k property would be a down payment of $35k. Rent can be very significant in this strategy, but for simplicity let’s say it’s $900 a room and the house has five available rooms to rent. That puts you at $4,500 a month rent vs. a PITI (principal, interest, ta, insurance) of around $2,900. At a modest appreciation rate of just 3% the total return of this property between cash flow, appreciation, and amortization would be upwards of 80% per year.

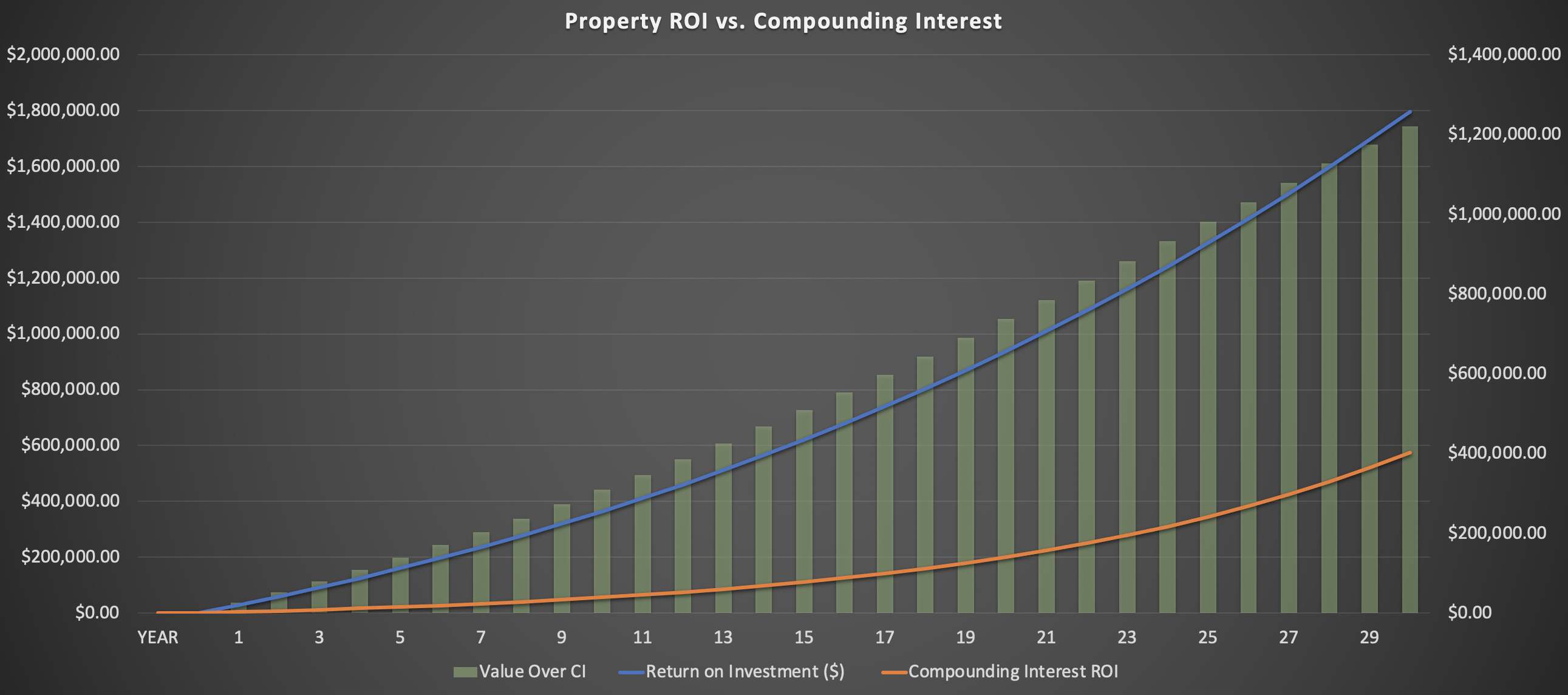

To put that into perspective, this is that return on investment (blue) measured measured against a compounding interest rate of 10% (orange) over a thirty year period (the life of the loan).

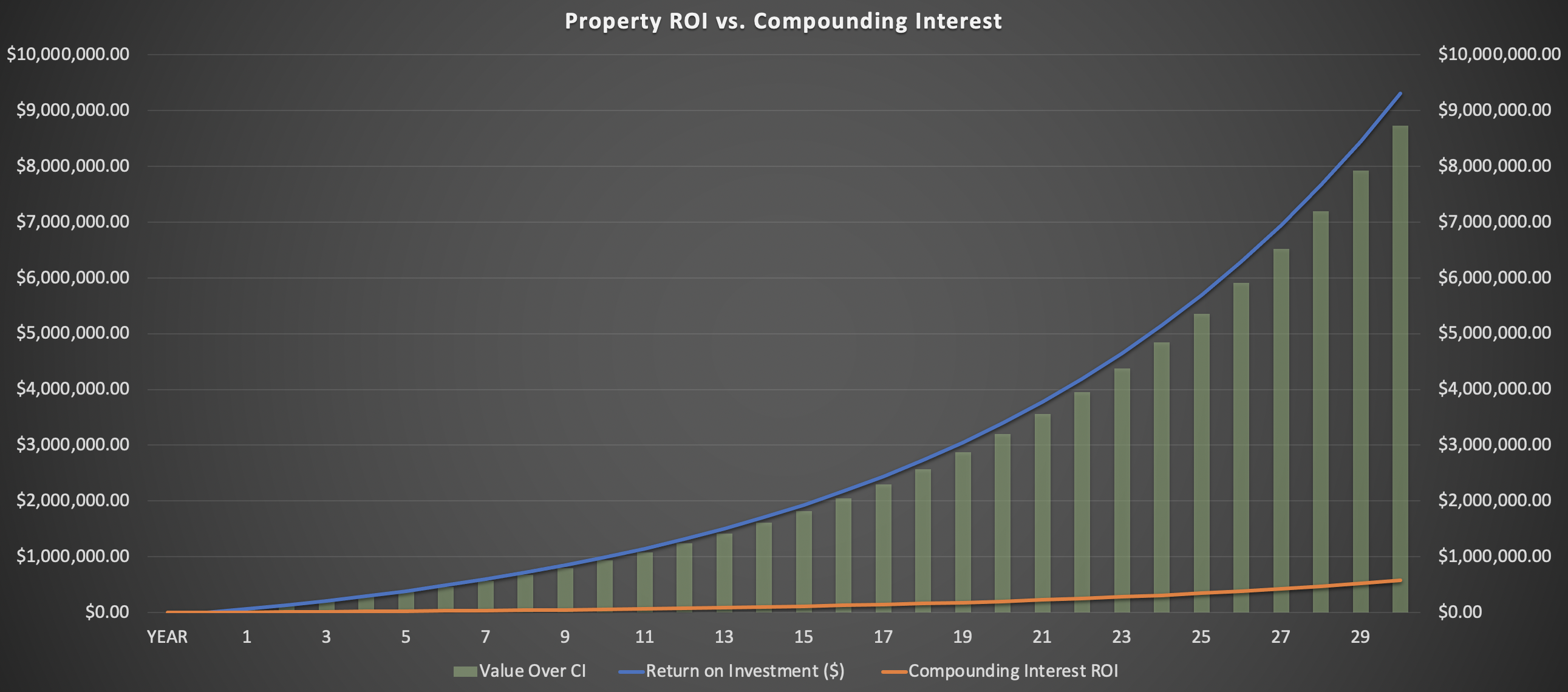

In ten years at that rate of return, the principal $35k would be worth over $250k. If appreciation were closer to 10% (second chart below), it would be worth over a million. If you repeated this strategy with a new property every two years in a high appreciation market for ten years and re-leveraged consistently as you reached high equity, you could be looking at seven figures in two decades.

That’s a lot of wealth with not a lot of effort, and, while overly simplified, the example demonstrates that you do not need unlimited energy or money; you just need know how to leverage what’s available.

Conclusion

Wealth is a hot button topic these days. To cut through the noise, you might replace the idea of wealth with the idea of security. To recognize that security is the key to growth and prosperity is then to realize that accumulating security is a path towards better outcomes.

To start on this path, a good first step is self-assessment. Where are you relative where do you want to be?

A second step is self-education. Given where you want to be, what do you need to learn?

A final step is disciplined execution. Whether that be investing in equities, real estate, or even your own business, what’s important is that money be put to work so that it may grow into security that allows you to not just survive, but to flourish.

Great post!