Lead Source: MLS

Strategy: BRRR

Purchase Price: $80,000.00

Rehab Budget: $61,000.00

Appraised value: $183,000.00

Rent: $1,350.00

Cash left in deal: $5,000.00

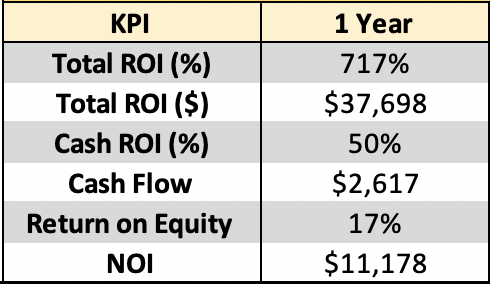

Year 1 KPIs (not including initial equity):

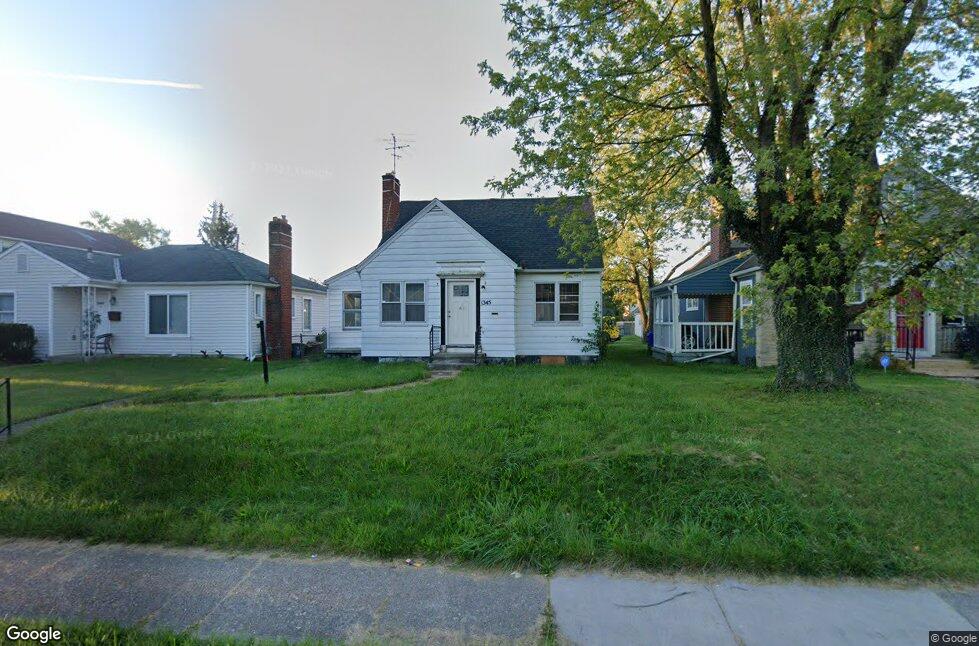

1345 E Hudson was one of our first five rentals. We purchased this one on the MLS (probably the last of it’s kind for a while) in pretty rough shape and without much experience. In retrospect, we got lucky with the results… this one came close to being a clean BRRR and, more importantly, hit all the numbers we target with our property model.

The theme for this one was “nothing fancy.” The goal was to mostly repair and bring finish levels up to market standards for rentals. We inherited some nice wood floors, which is always a plus, and focused scope in the kitchen, two full bathrooms and the finished cape cod room upstairs.

As a bonus, we also got to tear down this beauty out back:

At purchase, this guy needed just about everything.

Before:

After: take a stroll through the final product .

The major mistake made was to take on a bigger rehab project without a fully vetted contractor. The result was a prolonged project timeline and having to switch contractors halfway through. While the deal ended up being decent, we closed with cash and tied up too much capital in the time it took us to complete the project. Returns are diluted when opportunity cost is factored in.

This is a classic lesson that we had encountered many times in books, but it still took a trial by fire to hammer it home.

Deals like this are the bricks we are looking to lay in the foundation of our rental portfolio. They can be turned fast, tend to appreciate rapidly, and, as they’re drawing from a large applicant pool, have little to no vacancy year over year.

One of these properties doesn’t move the needle much. A set of twenty starts to gain some momentum.

More to come.

Recent Comments